WHY YOU SHOULD CONSIDER GETTING TRAVEL PROTECTION?

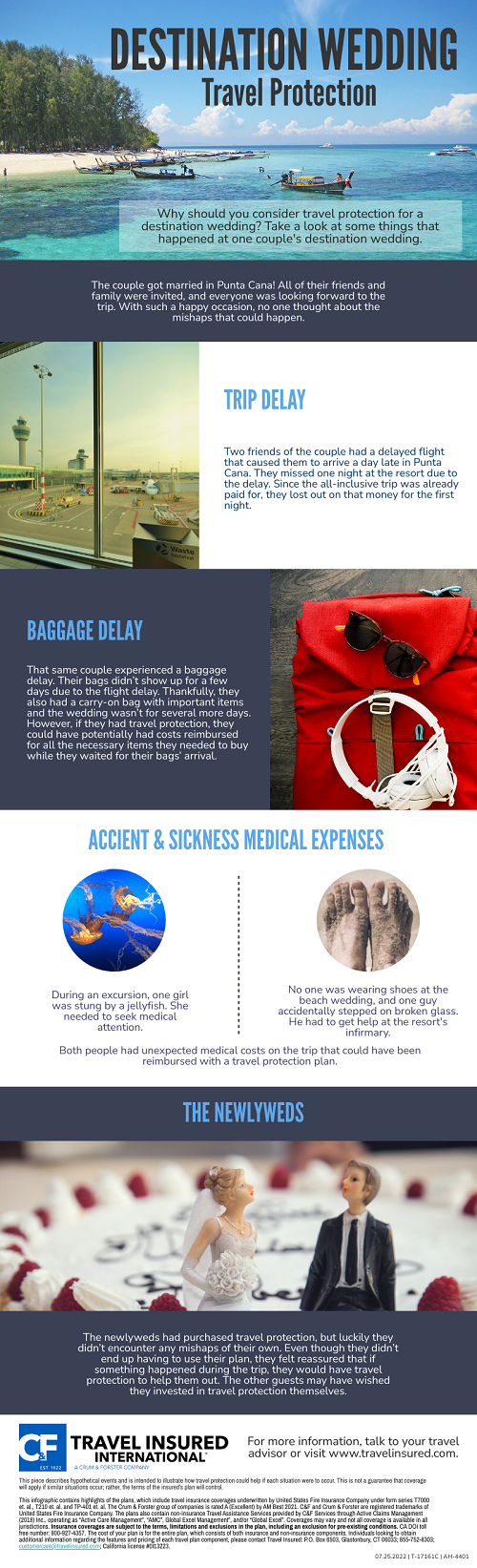

A lot of people plan and look forward to traveling each year, but how many actually invest in travel protection? Travel protection can be a great investment no matter what age you are or where you plan to go. Whether you’re traveling for business or for pleasure, travel protection is there to help you should the unexpected occur. Let’s take a look at some of the ways that travel protection can be there for you if things go wrong.

It can help protect your personal belongings

Nowadays, when we travel, many of the items that we bring with us are quite valuable. Think about your phone, tablet, laptop, or camera. If these items were to get lost, damaged or stolen, you’d not only be really bummed out, but you may even find that you can no longer access important documents, phone numbers, and technological abilities that you rely on. And what about items we don’t usually consider losing during a trip? Think about your important travel documents such as trip information, visa information, your passport and more. Travel protection may help you out by reimbursing you for the repair or replacement of covered items.

Can protect your budget.

When we venture out, budgeting our money plays a large role in the way our trips pan out. If something unexpected were to happen, it could ruin your planned budget. Consider what you would do if you needed to see a doctor abroad for something like food poisoning. You would likely have to pay for your medical expenses out of pocket. Having travel protection in place can help you feel more at ease financially in unexpected medical situations.

Travel medical emergencies can happen.

Although we hope our trip will only be filled with great memories and fun times, unfortunately getting sick or injured on vacation is a possibility. Some health care plans in the U.S. may not cover you when you travel abroad. It is important to consider this when traveling away from home. Travel protection plans may be able to help you when you’re most in need. This is just one more reason to consider a plan next time you set out on an adventure.

Delays are unpredictable.

Short trips have become more popular in past years, with people taking advantage of long weekends to satiate the itch they have for travel. Instead of taking week-long trips, they’re maybe taking a 3- or 4-day trip. Now imagine having a delay that forced you to miss a day of activities on a short 3-day trip. It would be frustrating but travel protection could at least help you get your covered lost expenses back. Additionally, you could get reasonable additional expenses reimbursed, such as meals or a hotel.

You can be covered for trip cancellation.

There are many covered reasons for trip cancellation, including things like sickness, injury or a death of a family member. If you need to cancel your trip for reasons not already covered by the plan, some plans offer the option to purchase a Cancel for Any Reason benefit. *

TO REQUEST A QUOTE, YOU WILL NEED THE FOLLOWING INFORMATION:

State of Residence

Travel Dates

Travelers’ Ages or Dates of Birth—at the time of booking

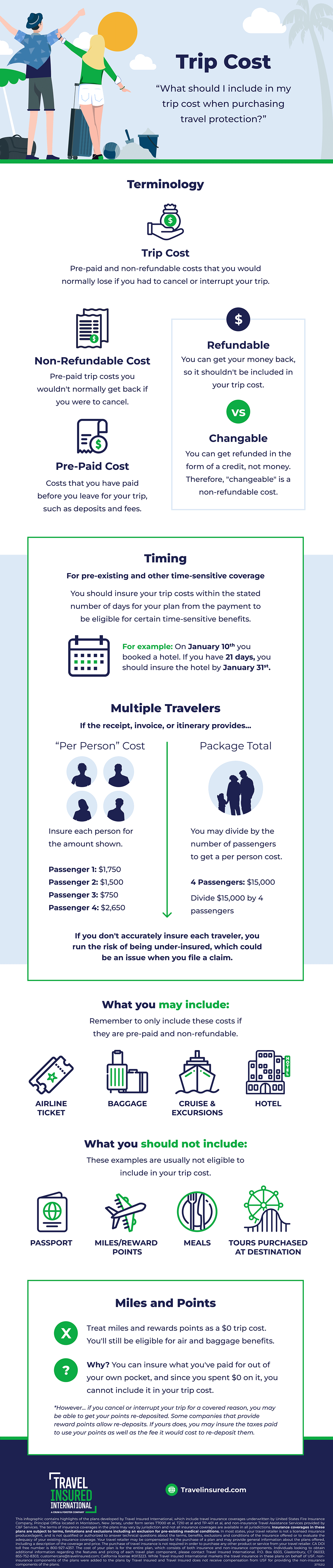

Trip Cost Per Person (air, cruise, tour—anything that is prepaid and nonrefundable)

Deposit Date: This is the first day they made a payment towards the trip.

Destination